AuthorRMCTax

With the publication of FTA Decision No. 3 of 2024 yesterday by the Federal Tax Authority (FTA), a clear framework has been established regarding the Registration Deadlines for taxable entities under the UAE Corporate Tax Law. Cabinet Decision No. 75 of 2023 in alignment with this decision, introduces administrative penalties for failure to register potentially resulting in a fine of AED 10,000.

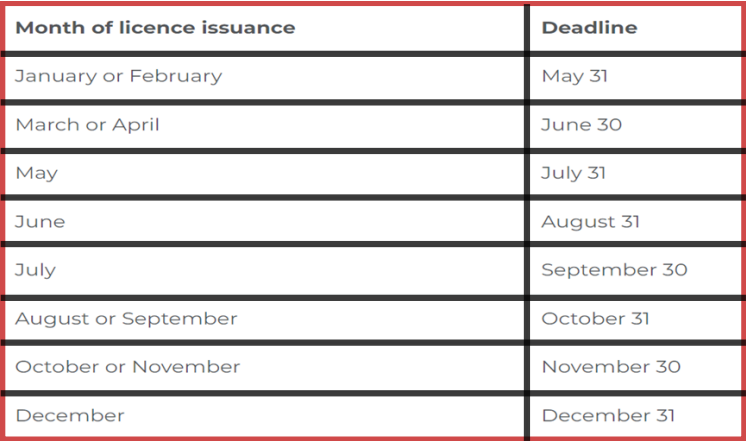

1. Deadline for the Registration of Resident Juridical Persons (such as LLCs, Private & Public Joint Stock Companies, Foundations, Trusts including Free Zone Persons) for businesses incorporated before 1st March 2024:

2. The Deadline for Resident Natural Persons (individuals, owners and partners of Sole Proprietorship & Civil Companies etc) with a turnover exceeding 1 million is 31st March of the subsequent year.

3. Non-resident persons (individuals Foreign Nationals & Foreign Companies) meeting certain conditions have registration deadlines ranging from Three Months to Nine Months from the occurrence of a certain event.

4. For New Businesses incorporated and licenses issued after 1st March 2024, the registration deadline is mostly three months from the date of its incorporation with certain exceptions for special categories of persons.

By CA NishantRayma Partner – UAE Corporate Tax

0 Comments

Your email address will not be published. Required fields are marked *