Corporate Tax & VAT Services

Corporate Tax & VAT Services

RMC offers expert Corporate Tax and VAT services, ensuring compliance, accurate filings, strategic planning, and seamless support for UAE businesses. We help reduce risks, optimize tax efficiency, and maintain full FTA compliance with reliable advisory solutions.

- Corporate Tax Registration

- Corporate Tax Return Filling

- Corporate Tax Compliance Services

- Corporate Tax Representation and Litigation Support

- Tax Residency Certificate (TRC)

- Tax Clearance Certificate

- VAT Refund Services

- VAT Compliance Services

- VAT Audit Services

- VAT Representation and Litigation Support

- VAT Deregistration Services

We are pleased to assist you with all your Corporate Tax & VAT requirements.

Corporate Tax

Corporate Tax Registration

RMC provides seamless Corporate Tax Registration Services in the UAE, ensuring businesses comply with FTA requirements accurately and on time.

Corporate Tax Registration

RMC provides seamless Corporate Tax Registration Services in the UAE, ensuring businesses comply with FTA requirements accurately and on time. Our experts manage the complete registration process, from preparing required information and assessing eligibility to submitting the application on the FTA portal.

We review your business structure, financial details, and licensing information to ensure correct registration and prevent delays or discrepancies. Our team also guides you on ongoing compliance, documentation, and key obligations after registration.

With RMC’s professional support, businesses can complete their Corporate Tax registration smoothly, avoid administrative issues, and begin their compliance journey with confidence and clarity.

Corporate Tax Return Filing

RMC offers reliable Corporate Tax Return Filing Services in the UAE, ensuring businesses submit accurate, compliant, and timely returns in accordance with FTA regulations.

Corporate Tax Return Filing

RMC offers reliable Corporate Tax Return Filing Services in the UAE, ensuring businesses submit accurate, compliant, and timely returns in accordance with FTA regulations. Our specialists review your financial statements, adjustments, tax computations, and supporting documentation to ensure precision and full regulatory alignment.

We handle the complete filing process—calculating taxable income, identifying allowable deductions, validating disclosures, and submitting the final return on the FTA portal. Our proactive approach minimizes errors, reduces the risk of penalties, and ensures a smooth filing experience.

With RMC’s professional oversight, businesses can meet their Corporate Tax obligations confidently while maintaining accuracy, transparency, and ongoing compliance.

Corporate Tax Compliance Services

RMC provides comprehensive Corporate Tax Compliance Services in the UAE, ensuring businesses meet all ongoing obligations under the Corporate Tax Law with accuracy and consistency.

Corporate Tax Compliance Services

RMC provides comprehensive Corporate Tax Compliance Services in the UAE, ensuring businesses meet all ongoing obligations under the Corporate Tax Law with accuracy and consistency. Our experts monitor regulatory updates, review your financial records, and assess tax positions to ensure full alignment with FTA requirements.

We assist with maintaining proper documentation, preparing tax computations, meeting filing deadlines, managing disclosures, and addressing compliance risks before they lead to penalties. Our team also supports periodic reviews, reconciliations, and the implementation of robust internal controls for sustainable tax governance.

With RMC’s professional compliance support, businesses can operate confidently, minimize risks, and maintain a strong, transparent compliance framework throughout the Corporate Tax cycle.

Corporate Tax Representation & Litigation Support

RMC provides professional Corporate Tax Representation and Litigation Support Services in the UAE, assisting businesses.

Corporate Tax Representation & Litigation Support

RMC provides professional Corporate Tax Representation and Litigation Support Services in the UAE, assisting businesses in resolving tax disputes and managing complex interactions with the FTA. Our experts represent clients during audits, assessments, clarifications, and reconsideration requests, ensuring clear communication and accurate presentation of facts.

We analyse tax positions, prepare supporting documentation, draft responses to FTA inquiries, and guide businesses through objections, appeals, and dispute resolution procedures. Our team works to mitigate risks, defend your tax position, and secure fair outcomes in line with UAE Corporate Tax regulations.

With RMC’s trusted representation, businesses gain confidence, clarity, and strategic support throughout the dispute and litigation process, ensuring their rights and interests are fully protected

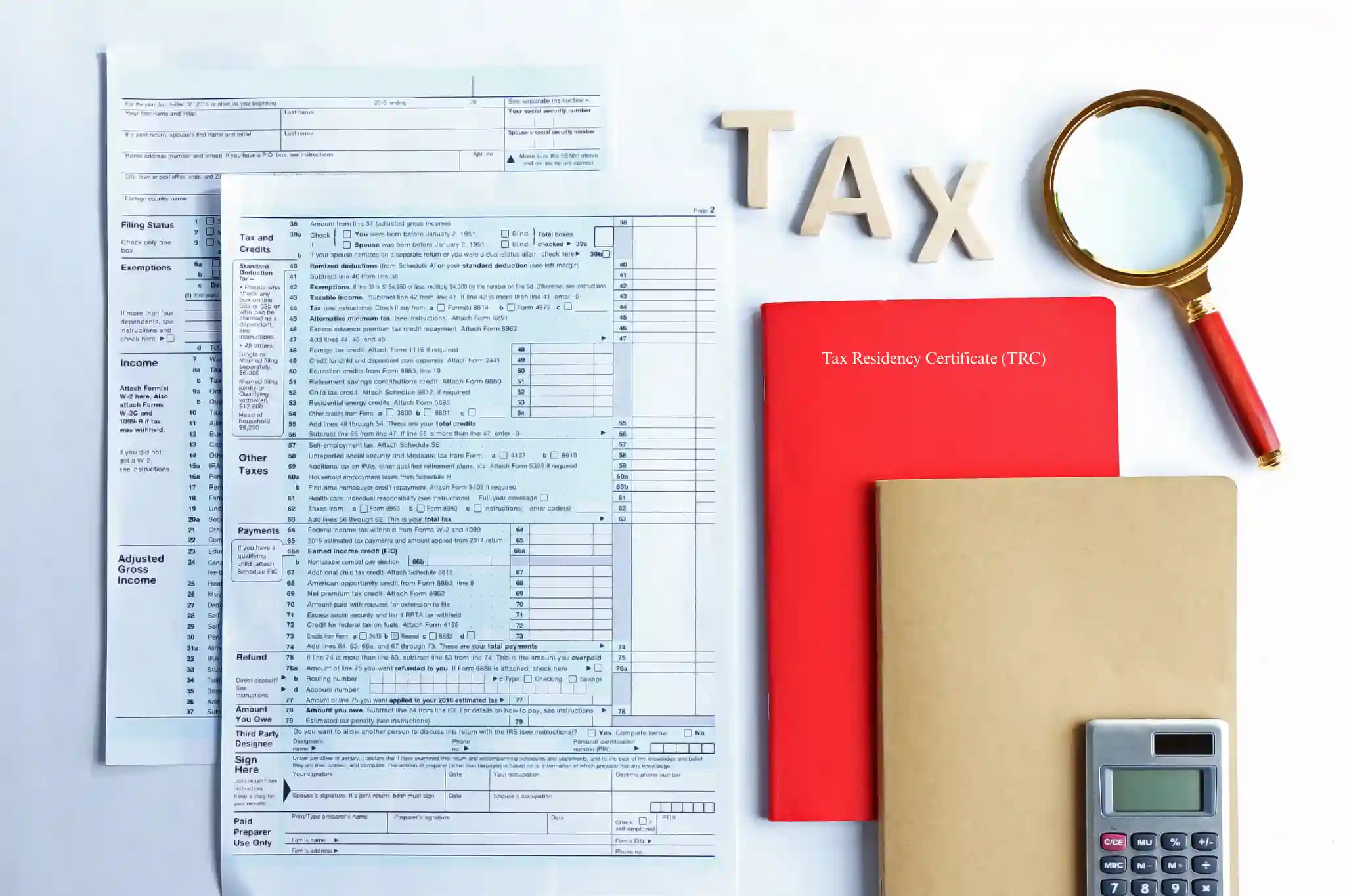

RMC LLC helps for TAX

We are providing support for Tax Residency Certificates (TRC) and Tax Clearance Certificates with quick processing and complete documentation assistance.

Tax

Tax Residency Certificate (TRC)

RMC provides end-to-end assistance in obtaining the Tax Residency Certificate (TRC) in the UAE, enabling businesses and individuals to benefit from Double Taxation Avoidance

Tax Residency Certificate (TRC)

RMC provides end-to-end assistance in obtaining the Tax Residency Certificate (TRC) in the UAE, enabling businesses and individuals to benefit from Double Taxation Avoidance Agreements (DTAAs) and confirm their tax residency status. Our team manages the complete application process, including eligibility assessment, document preparation, portal submission, and follow-up with the relevant authorities.

We ensure that all financial statements, supporting records, and required documents meet the standards set by the Ministry of Finance, reducing the likelihood of delays or rejections. With our professional guidance, clients can secure the TRC smoothly and utilize it to optimize cross-border tax planning and avoid double taxation.

RMC’s streamlined TRC service ensures accuracy, compliance, and timely issuance—supporting your international tax needs with confidence and efficiency.

Tax Clearance Certificate

RMC provides comprehensive support in obtaining the Tax Clearance Certificate (TCC) in the UAE, ensuring businesses meet all FTA requirements for tax compliance.

Tax Clearance Certificate

RMC provides comprehensive support in obtaining the Tax Clearance Certificate (TCC) in the UAE, ensuring businesses meet all FTA requirements for tax compliance. Our experts manage the full process, including reviewing financial records, verifying tax positions, preparing required documentation, and submitting the application to the authorities.

We guide clients through any queries or clarifications from the FTA, helping to resolve potential issues and ensuring timely approval. With RMC’s professional assistance, businesses can obtain the TCC smoothly, demonstrating full compliance and facilitating corporate transactions, exits, or restructuring with confidence.

RMC LLC helps for VAT

We support clients with reliable VAT services, registration, filing, and compliance guidance.

VAT

VAT Registration Services

RMC provides comprehensive VAT Registration Services in the UAE, guiding businesses through the entire registration process with the FTA efficiently and accurately.

VAT Registration Services

RMC provides comprehensive VAT Registration Services in the UAE, guiding businesses through the entire registration process with the FTA efficiently and accurately. Our experts assess eligibility, prepare required documentation, and submit applications to ensure timely and compliant registration.

We also advise on post-registration obligations, record-keeping, and reporting requirements, helping businesses maintain ongoing VAT compliance. With RMC’s professional support, companies can complete VAT registration smoothly, avoid errors or delays, and focus on their core operations with confidence.

VAT Return Filing Services

RMC offers reliable and accurate VAT Return Filing Services in the UAE, assisting businesses in preparing and submitting their VAT returns in full compliance with FTA requirements.

VAT Return Filing Services

RMC offers reliable and accurate VAT Return Filing Services in the UAE, assisting businesses in preparing and submitting their VAT returns in full compliance with FTA requirements. Our specialists review financial records, verify VAT calculations, and ensure all taxable supplies, purchases, and adjustments are reported correctly and on time.

We also provide guidance on input and output VAT reconciliation, proper documentation, and error-free filing procedures to help businesses avoid penalties or discrepancies. With RMC’s expert support, companies can manage their VAT return cycle efficiently, maintain ongoing compliance, and focus on their core activities with peace of mind.

VAT Refund Services

RMC provides end-to-end VAT Refund Services in the UAE, helping businesses recover eligible input VAT efficiently and in full compliance with FTA regulations.

VAT Refund Services

RMC provides end-to-end VAT Refund Services in the UAE, helping businesses recover eligible input VAT efficiently and in full compliance with FTA regulations. Our experts review invoices, expenses, and documentation to ensure accurate refund claims and identify all recoverable VAT.

We manage the complete process—from preparing and submitting refund applications to following up with the FTA—minimizing errors, delays, and the risk of rejections. With RMC’s professional support, businesses can optimize cash flow, maintain compliance, and maximize VAT recovery with confidence and efficiency.

VAT Compliance Services

RMC offers comprehensive VAT Compliance Services in the UAE, ensuring businesses adhere fully to FTA regulations with accuracy and timeliness.

VAT Compliance Services

RMC offers comprehensive VAT Compliance Services in the UAE, ensuring businesses adhere fully to FTA regulations with accuracy and timeliness. Our experts monitor transactions, review invoices, and maintain proper documentation to support correct VAT reporting and filing.

We assist with VAT registration, periodic return filing, reconciliations, record-keeping, and compliance reviews, helping businesses avoid penalties and mitigate risks. With RMC’s professional guidance, clients can maintain robust VAT compliance, streamline processes, and operate confidently within the UAE tax framework.

VAT Audit Services

RMC provides professional VAT Audit Services in the UAE, helping businesses prepare for and navigate FTA audits with confidence.

VAT Audit Services

RMC provides professional VAT Audit Services in the UAE, helping businesses prepare for and navigate FTA audits with confidence. Our experts conduct thorough reviews of transactions, invoices, and accounting records to identify risks, errors, and non-compliance issues before the audit.

We assist in audit preparation, documentation, and representation, ensuring clear communication with the FTA and timely resolution of queries. With RMC’s proactive approach, businesses can minimize penalties, address compliance gaps, and maintain accurate, audit-ready VAT records.

VAT Representation & Litigation Support

RMC provides expert VAT Representation and Litigation Support Services in the UAE, assisting businesses in managing disputes

VAT Representation & Litigation Support

RMC provides expert VAT Representation and Litigation Support Services in the UAE, assisting businesses in managing disputes, audits, and inquiries with the FTA. Our specialists represent clients during audits, objections, and appeal processes, ensuring accurate and professional communication of your tax position.

We review transactions, prepare supporting documentation, and develop strategic responses to safeguard your interests. With RMC’s guidance, businesses can effectively resolve VAT disputes, mitigate risks, avoid penalties, and maintain compliance with UAE VAT regulations.

VAT Deregistration Services

RMC provides expert Corporate Tax Advisory Services in the UAE, helping businesses stay compliant, tax-efficient, and future-ready. Our qualified tax professionals guide you through UAE Corporate Tax laws, registration, filing, documentation, and compliance. We offer tailored tax planning, error-free return filing, and strategic advisory to reduce penalties and optimize tax outcomes. Whether you are a startup, SME, or multinational, RMC ensures end-to-end support with updated knowledge of FTA regulations. Stay compliant, reduce risks, and focus on growth while we manage your corporate tax responsibilities with accuracy and integrity.

Corporate Tax & VAT Services

We provide reliable Corporate Tax and VAT services to ensure compliance, accuracy, and smooth business operations.